MSME’s Sector in India:

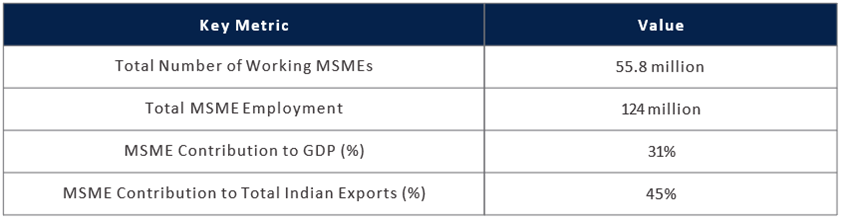

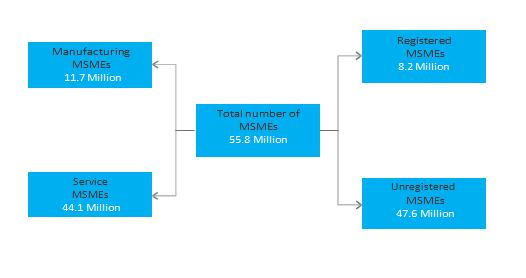

With a sustained growth rate of over 10% in the past few years, the MSME’s sector has come to represent the ability of the Indian entrepreneur to innovate and create solutions despite the logistic, social, and resource challenges across the country. As the nation’s largest employer, generating more than 124 Million jobs through close to 56 Million enterprises and contributing 31% of the nation’s GDP and 45% of the country’s overall exports , the relevance and role of the MSME’s sector as the central driving force behind India’s assertive vision to be a dominant global economic power cannot be overemphasized. Given that MSME’s essentially rely on traditional or inherited skills and use of local resources, particularly in rural and industrially underdeveloped areas, the sector has the ability to empower traditionally resource-poor communities and markets to mobilize products and services, both nationally and globally.